How Right Sizing & Right Pricing Impact Real Estate Value

Secured lenders offering mortgage loans on new or existing properties need to evaluate both building and land costs to understand the viability of a real estate investment given a required rate of return. Developments where dirt (land and site preparation costs) as well as building costs exceed the market value of the real estate can result in banks taking back overvalued properties to their REO inventories.

Commercial real estate value is determined by the highest and best use of the land. Value is largely determined by cash flows employed from the incomes, expenses, financing structure, and cost of development (project costs). Land use is also influenced by, but is not limited to

- Size

- Physical aspects of the land

- Development costs

- Existing surrounding uses

- Traffic flow

- Financial environment

- Zoning

- Demographics

- Market conditions

- Regional activities

For a real estate developer, purchasing development land and building the improvements at the right price is critical for the income stream and profits generated by years of successful operational management to follow.

Land costs often represent 20% to 40% of the total development costs. A “right sized” property is ideal but often not available, causing excess land to be part of the negotiation. Although excess land can be an amenity, it generally has relatively little impact on revenues while at the same time increasing maintenance and property tax expenses. There are limits to land value based on its use and investment potential.

During the development pro forma stage, careful evaluation should also be considered to total project costs. It may be useful to consider two types of subcategories – dirt costs and building costs.

Dirt costs are the property specific expenses associated with preparing the property for its intended development use. The costs generally include excavation, utility installation, parking lot, landscaping, and incidental expenses (if not already included by the building contractor). Building costs are the costs associated with erecting the improvements regardless of location. Combined, these two expense categories total to project costs, which often exceed their initial estimates. Cost overruns, strikes, work stoppages, and other unanticipated expenses can cause construction cost to increase significantly.

Evaluating the impact of land size and development costs have on negotiated land offers can have a dramatic influence on the total project cost and return on investment.

Take, for example, a small 10,000 sq ft office building anticipating net leases at $14/sq ft, 5% vacancy, 25% operating expenses, and 8% financing over a 25-year amortization. At a 1.2 debt service ratio, the investment is worth approximately $1,120,000 at a 15% rate of return.

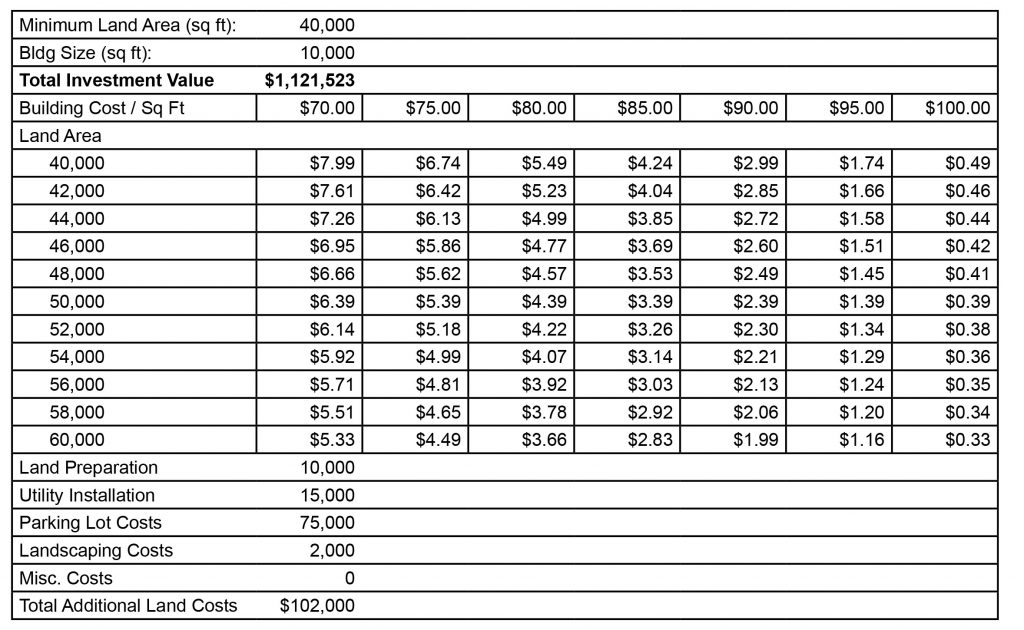

Assuming the land area is required to be at least four times the size of the building, this building would require a minimum 40,000 sq ft rectangular-sized property. The matrix below demonstrates the maximum acceptable square foot land values for varying building cost per square foot expenses that maintain the expected investment returns.

Given the assumptions noted above, this table demonstrates that a “right sized” (or 40,000 sq ft) land size and a building cost of $70/sq ft would support a maximum land purchase price of $7.99/sq ft. If the building cost is anticipated to be $80/sq ft, then the maximum land purchase price drops $5.49/sq ft (a 31% decrease).

Likewise, if the available land size for this development is 46,000 sq ft (representing 6,000 sq ft of excess land), the maximum price should not exceed $6.95/sq ft at a $70/sq ft building cost. This price represents a 13% drop in land value compared to a “right sized” land value.

Combining the two scenarios of increased building costs of $80/sq ft and adjusted dirt costs due to excess land of 6,000 sq ft, the maximum price for land equates to $4.77/sq ft, representing a 40% decrease.

Compliance and Collateral Examination Services understands the various methodologies used to value commercial real estate properties. Call us today at 636-386-2800 for your due diligence needs.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.