In the commercial finance industry, real estate is often considered a critical source of collateral value supporting a credit relationship. Whether real estate is used as a primary collateral component or a secondary one, a decrease in its value will increase the overall credit risk for the creditor.

Risk factors affecting real estate and how they impact its value would be important criteria for the lending decision maker to consider.

Investment real estate is conceptually the easiest to understand since decreases in revenues, increases in expenses, or adverse changes in financing have a direct impact on cash flow and therefore value. In the owner-user real estate situation, the changes in real estate value may not be so obvious. For example, decreases in area sale/rental rates of “like kind” property, rising operating expenses, taxes, deferred maintenance, environmental issues, and negative national/regional economic trends will adversely impact value requiring additional due diligence by the lender.

With respect to investment real estate, significant changes to value can result from subtle changes in interest and vacancy rates, as reflected below.

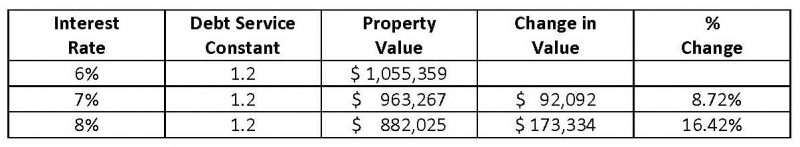

The impact that changes in interest rates have on property value are best illustrated by the following matrix:

In this scenario, increased interest rates from 6% to 7% and maintaining the same DSC results in a decrease in property value of $92,092 (8.72%), while a change from 6% to 8% decreases property values by $173,334 (or 16.42%).

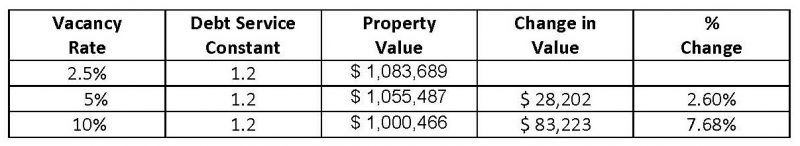

The impact that changes in vacancy rates have on property value are best illustrated by the matrix below.

In this scenario, increasing the vacancy rate from 2.5% to 5% decreased the property value $28,202 (or 2.60%), while a change in vacancy rate from 2.5% to 10% decreases property values by $83,223 (or 7.68%).

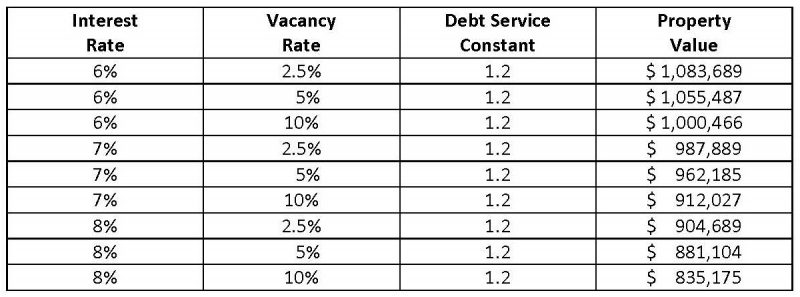

Combining the two scenarios with their multiple outcomes serves to illustrate that property once at a 6% interest rate and 2.5% vacancy and is later found to be in a financial environment of 8% market interest rate and a 10% vacancy rate can result in a 23% loss of market value of nearly $250,000.

At this point, from the lender’s perspective, the loan-to-value ratio may well be at unacceptable levels. From the borrower’s perspective, all of the owner’s equity may have vanished and the bank could find itself in a “take over” situation should the owner decide to walk away from the property. These situations happen and they very easily can be much worse.

Also to be considered are the changes in real property value caused by expenses and cap rates. These variables also have significant impact on value. Detailed investigations of all revenues, expenses, financing changes, and market conditions can help lenders foresee problems before they evolve into portfolio losses.